Introduction: A World in Flux

The global economy is in flux. Every day brings new headlines—tariffs on the rise, bond markets flashing warning signs, inflation refusing to cooperate, and central banks trying to work their magic without triggering panic. Markets have become a rollercoaster, and for investors, the ride is far from enjoyable.

The truth, however, is simple: capital is moving. It always does. Smart investors know that market shifts aren’t random—they follow patterns. And we are now in the middle of one of the biggest capital rotations in decades. This doesn’t happen often, but when it does, it reshapes portfolios, industries, and financial fortunes.

The last time we saw something like this? Think post-2000, when the internet bubble popped and money fled from overhyped tech stocks to safer, more tangible assets. Fast forward to today, and while the names have changed, the story is strikingly familiar. Investors once again find themselves at a crossroads, needing to choose between yesterday’s winners and tomorrow’s survivors.

This report will cut through the noise and lay out the facts: why capital rotation is happening, where the money is going, and how investors should position themselves to benefit from this rare shift.

The Capital Rotation Phenomenon

History Repeats Itself

Capital rotation is one of the market’s great inevitabilities. It’s not a question of if, but when. Markets get too excited about a sector, money floods in, valuations stretch beyond reason, and then reality hits. Investors wake up, reassess their risk, and move their money elsewhere. The cycle has played out time and time again.

Take the dot-com bubble of the early 2000s. Everyone was chasing the next big internet stock. Profits? Who cared. Valuations? Didn’t matter. If a company had a “.com” in its name, investors threw money at it. And then—pop. The party ended. Tech stocks collapsed, and capital rotated out of high-risk speculative plays into safer, tangible assets.

Fast forward to today. The Magnificent 7—Microsoft, Apple, Google, Amazon, Nvidia, Meta, and Tesla—have dominated the market for years. Their performance has been staggering, but trees don’t grow to the sky. Valuations are stretched, competition is heating up, and the easy money that fueled their rise is drying up. While the names are different, the pattern is the same. The market is rotating.

Why It’s Happening Now

Several forces are driving this shift:

- Economic Uncertainty: Inflation, tariffs, and geopolitical tensions are making investors nervous. When uncertainty rises, money moves to safer havens.

- High Valuations: Stocks—especially in tech—have been bid up to extreme levels. Eventually, gravity wins.

- Rising Interest Rates: Easy money is disappearing. As rates rise, speculative stocks become less attractive.

- Market Fatigue: Investors are realizing that what worked in the last decade won’t necessarily work in the next one.

- Trade Policy Disruptions: The newly announced global tariffs will increase costs for multinational companies, impacting supply chains and profitability, further encouraging a shift toward domestic and hard assets.

So, where’s the money going? The answer lies in the assets that have historically thrived during capital rotation events and the uncertainty that drives them.

Gold vs. Stocks: A Time-Tested Shift

The Resurgence of Gold (and Its Metal Cousins)

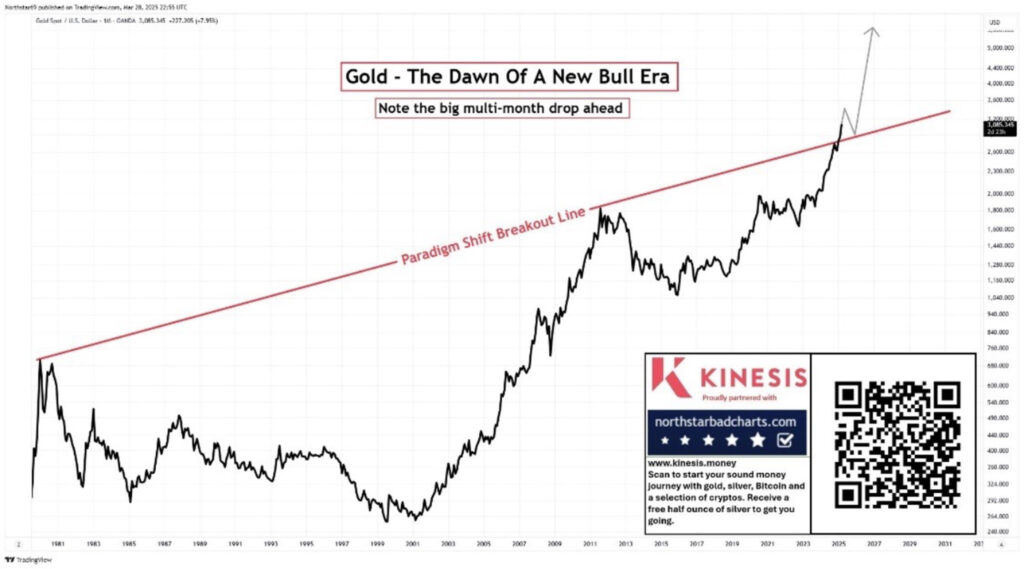

When stocks struggle, gold shines. Always has, always will. Unlike stocks, gold doesn’t rely on quarterly earnings reports or CEO promises—it simply exists, holding its value as everything else swings wildly. But this time, it’s not just about gold.

Silver, platinum, and copper are all seeing renewed investor interest. Why? Because in times of uncertainty, tangible assets matter. During the 2008 financial crisis, when stocks crashed, gold surged over 100% in five years. But it wasn’t alone—silver skyrocketed even more, and copper rebounded sharply as investors piled into tangible assets.

In this capital rotation, expect the same. Gold will lead, but silver, platinum, and copper will follow. Silver, often called “gold’s cheaper cousin,” tends to outperform gold in bullish commodity cycles. Platinum and copper—both crucial for industrial applications—are also poised to benefit as capital flows into hard assets.

Tech’s Fading Luster: Lessons from 2000 and the Magnificent 7

History has a way of humbling the most overconfident investors. In 2000, internet stocks were invincible—until they weren’t. The Magnificent 7 of today have enjoyed a similar ride, but cracks are forming. From their peak last year, they have shed anywhere from 10% to 40% of their market value so far in 2025.

Consider Nvidia. A dominant player in AI, no doubt. But at a certain point, even the best companies get priced beyond perfection. Investors are beginning to ask: “How much higher can they go?” If history is any guide, the answer is not as high as people think. Since January, Nvidia is now down roughly 20%.

Nvidia Stock Price History

Without doubt, AI adoption has been rapid and represents a major technology shift that will have profound and lasting impacts, but investor focus has now shifted from underlying AI infrastructure to AI-agent-based use cases that generate materially superior business outcomes at far lower costs, largely through significantly reducing administrative overhead, and risk.

Bottom line, as capital rotates, the winners of the last cycle become the laggards of the next.

Beyond Gold: The Shift Toward Physical Commodities

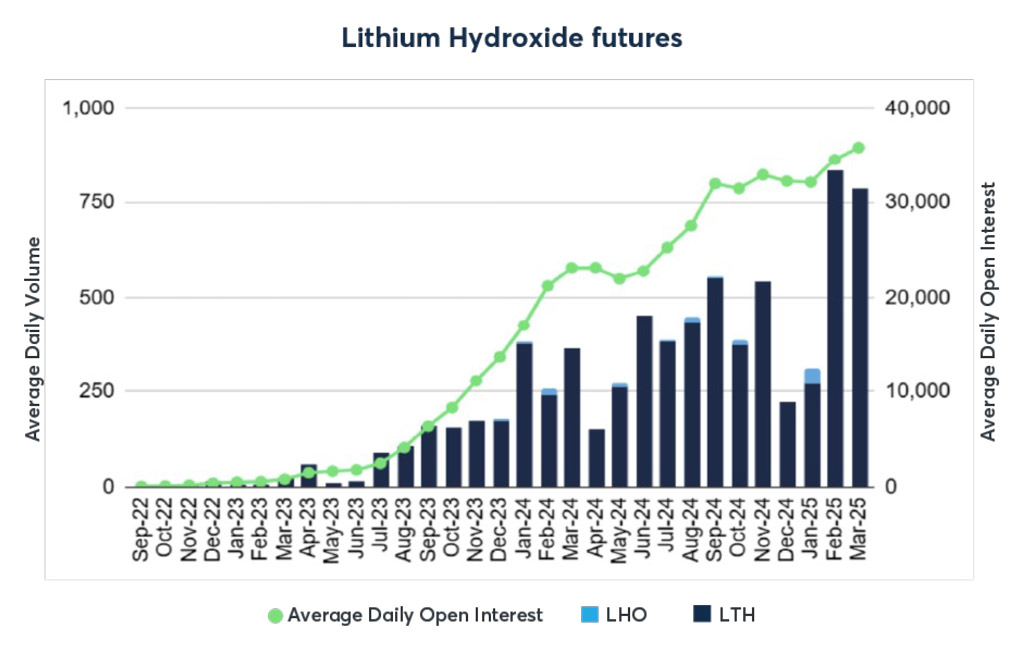

For decades, when markets turned rough, investors looked to bonds, defensive stocks, and real estate for shelter. That equation is changing. Traditional safe havens have problems, and investors are looking elsewhere. Lithium and cobalt, for example, set records in February.

Bonds and Defensive Stocks: Losing Their Shine

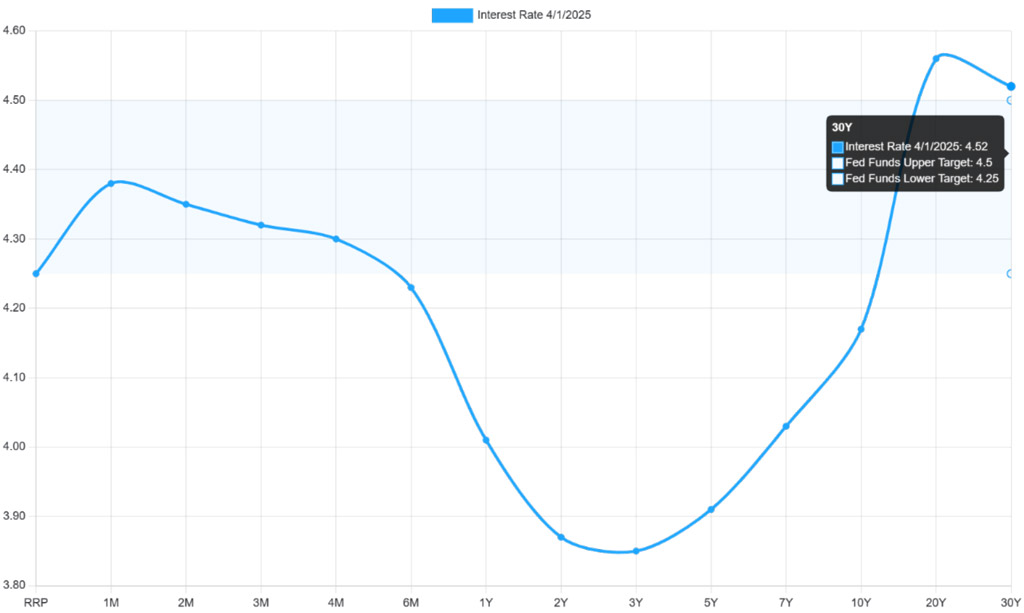

Bonds used to be the ultimate safe haven. Not anymore. Rising interest rates and economic uncertainty—especially around tariffs and trade policy—have made bond markets more volatile than ever. What was once a refuge now feels like a gamble given potential inflationary pressure.

US Yield Curve

Defensive stocks—utilities, healthcare, consumer staples—still have a role to play, but they aren’t immune. High valuations and slowing growth mean investors need to look beyond the usual safe bets.

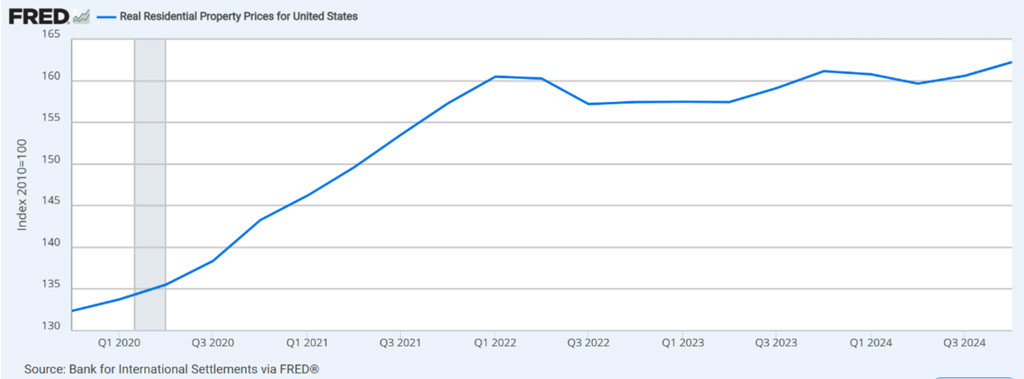

Real Assets: Overpriced and Risky

Real estate and infrastructure have long been considered stable investments. But are they still? Prices have soared to unsustainable levels, and the risk of a market correction is growing. Investors counting on real estate as a safe haven may be in for a surprise.

Physical Commodities: The New Focus

With traditional safe havens looking shaky, investors are shifting to physical commodities. Beyond gold, silver, platinum, and copper offer real, tangible value.

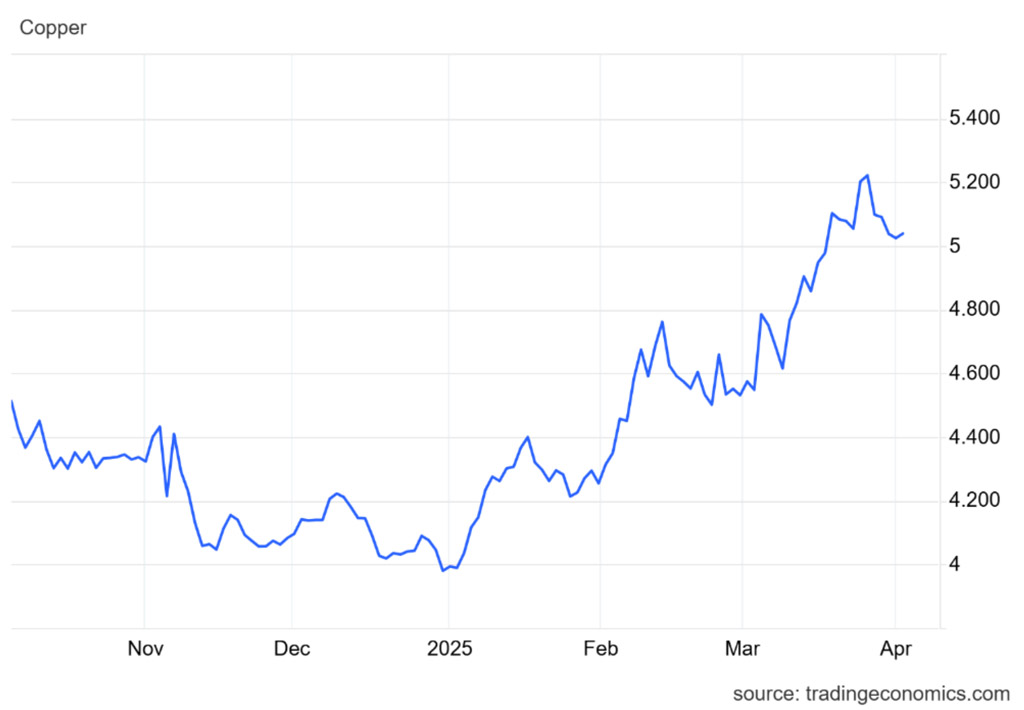

- Copper: The backbone of global infrastructure. If the world keeps building, copper will keep rising.

- Silver: More volatile than gold, but historically outperforms in bull cycles.

- Platinum: Critical for industrial use and poised for demand growth.

This is where capital is now rotating to. Not into speculative tech, not into overvalued bonds, but into physical assets that have proven their worth through every market cycle.

Conclusion: The Enduring Value of Simplicity

Capital rotation isn’t new—it’s inevitable. Markets get overextended, investors wake up, and money moves to where real value lies. The winners of yesterday don’t always win tomorrow.

Right now, we’re witnessing a major shift. The Magnificent 7, once the market’s darlings, are facing headwinds. Bonds and defensive stocks aren’t as safe as they used to be. Real estate is overpriced.

So where does the smart money go?

To real, tangible assets. Gold. Silver. Platinum. Copper. Hard assets that don’t rely on corporate earnings or government policy.

This report isn’t about chasing the next trend—it’s about recognizing the timeless truths of investing. When markets shift, the best strategy isn’t to cling to the past. It’s to adapt.

The capital rotation is here. The only question is whether you’ll move with it—or get left behind.

Spoiler Alert: The recent rise in physical commodity prices is poised to drive margin expansion for miners, setting off a dynamic M&A cycle. As companies leverage their improved profitability, we can expect a strategic realignment that ultimately leads to a significant rerating of the explorers.

About Moneta

Moneta is a boutique investment banking firm that specializes in advising growth stage companies through transformational changes including major transactions such as mergers and acquisitions, private placements, public offerings, obtaining debt, structure optimization, and other capital markets and divestiture / liquidity events. Additionally, and on a selective basis, we support pre-cash-flow companies to fulfill their project finance needs.

We are proud to be a female-founded and led Canadian firm. Our head office is located in Vancouver, and we have presence in Calgary, Edmonton, and Toronto, as well as representation in Europe and the Middle East. Our partners bring decades of experience across a wide variety of sectors which enables us to deliver exceptional results for our clients in realizing their capital markets and strategic goals. Our partners are supported by a team of some of Canada’s most qualified associates, analysts, and admin personnel.