Over our last two AI-related newsletters, we explored the emergence of agentic AI as a new strategic force reshaping the tangible economy – from autonomous operations in energy, logistics, and manufacturing, to the infrastructure and power required to support it. But as with every disruptive technology cycle, a wave of breathless claims and speculative fervor has emerged. The challenge for investors and operators today: separating the signal from the noise.

Let’s be clear – not every “agent” is agentic. And not every AI deployment creates durable value. In fact, recent research from MIT (State of AI in Business 2025) reveals that despite $30–40b in enterprise investment, 95% of organizations report no measurable P&L impact. Adoption is high but transformation is rare. Consumer-grade tools like ChatGPT thrive because they’re flexible and easy to try, but enterprise deployments often stall and many never make it past pilots. Even if they do, not every firm touting its agentic capabilities has the infrastructure – or the execution chops – to deliver on their full promise. True agentic autonomy requires persistence, memory, and contextual learning. Without those, deployments collapse into automation theater.

In this installment of our agentic AI series we tackle the critical question of separating the signal from the noise. For investors, operators, and policymakers navigating a flood of AI-first claims, discernment is no longer optional – it’s foundational to strategy.

The Anatomy of a Hype Cycle

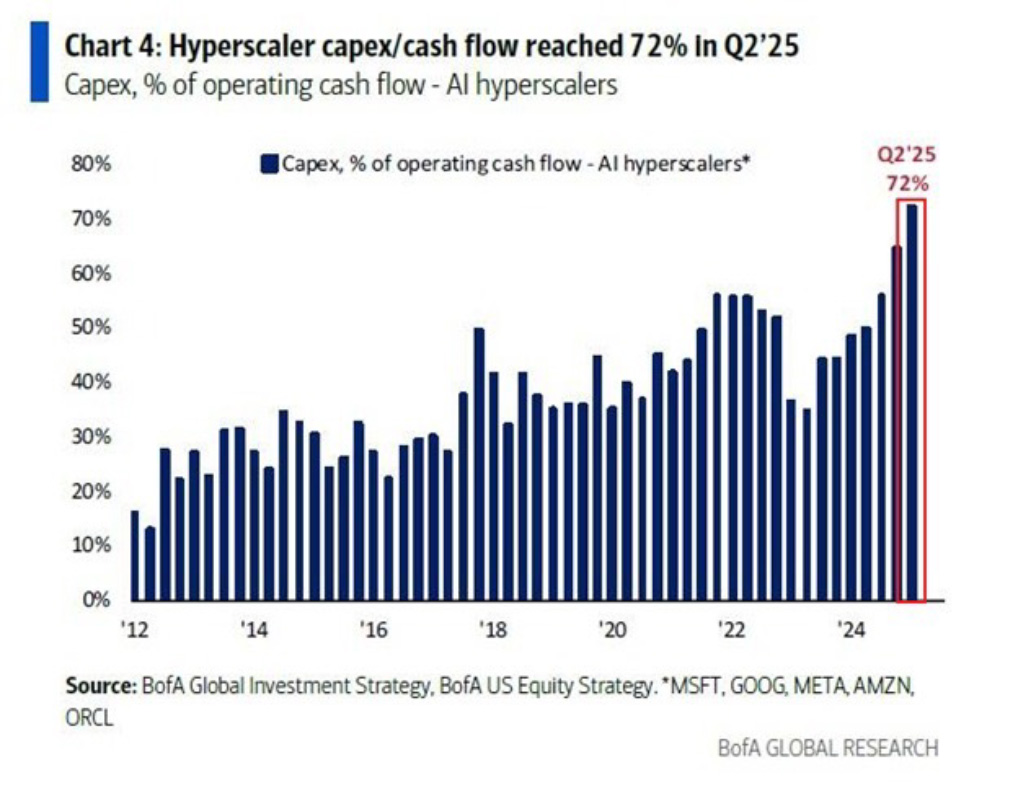

With AI investment soaring and hyperscaler CapEx expected by some analysts to hit as much as $433 billion by 2026, the challenge is especially critical. But we’ve seen this movie before. From the dot.com wave to cloud computing to crypto, technological shifts follow a predictable pattern:

- Breakthrough Moment – A new capability (like LLMs or autonomous agents) captures public imagination.

- Speculative Wave – Early adopters and startups race to reframe themselves as aligned with the trend, regardless of the actual depth of their offerings.

- Capital Inflow and Talent Flight – funding, media attention, and skilled labor flow toward the trend, boosting valuation multiples ahead of fundamentals.

- Correction Phase – Expectations reset as real-world friction, adoption bottlenecks, and unit economics reveal themselves.

- Consolidation – Winners with operational discipline and differentiated capabilities absorb weaker peers or scale into adjacencies or new verticals.

Agentic AI sits today squarely between phases 2 and 3. The imperative now is identifying who’s building durable moats – and who’s selling vaporware.

Five Tests to Cut Through the Noise

Here are five criteria we use to assess whether an “agentic AI” business – or vertical – is more signal than noise:

1. Does the Solution Truly Exhibit Autonomy?

Agentic AI is not just another chatbot, decision tree, or workflow rule engine. A real agentic system should demonstrate:

- Goal-driven behavior – Can it optimize toward critical business-defined outcomes?

- Operational independence – Can it execute a task end-to-end with minimal human input?

- Contextual adaptability – Can it adjust behavior in live environments with changing inputs?

Signal:

Systems with persistent memory and feedback loops that evolve over time.

Noise:

Static tools that “forget”, can’t adapt, and have no measurable business impact.

2. Is There a Clear Real-World Workflow Being Transformed?

The most promising agentic deployments are deeply embedded in important operational contexts such as energy trading, field service routing, customer service delivery, inventory optimization, regulatory compliance, or autonomous inspections. These are messy and sometimes unglamorous, but high-value workflows that have measurable business outcomes.

Signals:

- Deep integrations with physical systems, regulated environments, or mission-critical processes (e.g., energy routing, financial compliance, inventory management).

- Access to proprietary operational data streams.

- Demonstrated impact on key metrics (cycle time, error rate, unit margin, revenue generation).

Noise:

A slick UI layered on top of generic LLM APIs with no process ownership or connectivity with enterprise workflows.

3. What Are the Real Infrastructure Dependencies – and Are They Being Addressed?

As outlined in our last post on this subject, agentic AI demands significant investment in compute, energy, latency-sensitive networking, and storage. Real companies in this space are building or partnering to control these constraints.

Signals:

- Firms securing compute, energy, and latency as part of their moat.

- Ownership of or preferential access to compute infrastructure via close relationships with chipmakers, telcos, or smart grid providers.

- Optimizations in model routing, compression, or edge inference.

Noise:

Vendors assuming infinite API access to a large language model and claiming it a moat, without any proprietary data or regard for silicon, grid, or network constraints.

4. Is There Friction in Adoption – or Is It Touted as Plug-and-Play?

In high-hype environments, some friction can actually be a good sign. If a company is willing to go through somewhat complex onboarding and deployment processes it suggests they’re solving something non-trivial.

Signals:

- Willingness to invest in integration complexity because ROI is clear (e.g., BPO replacement, SLA improvement).

- Vertical specialization or custom model tuning for operational reliability.

- Willingness to participate in governance, auditability, and trust frameworks.

Noise:

“Plug-and-play across all industries” promises with no domain specialization, fine-tuning or customization required.

5. Is the Business Model Anchored in Value, Not Usage?

Many early-stage AI businesses default to volume-based pricing (per task, per token, per seat). But agentic AI’s real power lies in value creation – cost savings, compliance, risk reduction, revenue augmentation or margin improvement.

Signals:

- Pricing models tied to outcomes: % of cost savings, margin uplift, SLA improvement, P&L impact.

- Low churn rates and embeddedness in mission-critical workflows.

- Willingness to be benchmarked against existing manual or semi-automated processes.

Noise:

- Token-based consumption models with no correlation to enterprise outcomes.

- High burn rates with no unit economics, or freemium models that don’t convert.

Strategic Layer: Agentic Infrastructure

As discussed in our last AI-related newsletter, agentic AI is inseparable from physical constraints which include:

- Compute: Scarcity of GPUs/TPUs and new neuromorphic/photonic architectures.

- Energy: Clean, local, resilient grids as the “new oil” of autonomy.

- Network: Low-latency edge and 5G/6G for agent coordination.

- Cooling & Storage: Innovations in liquid/immersion cooling, edge data placement.

The winners won’t just own AI models – they’ll own (or partner into) this substrate.

The Next Horizon: From Agents to the Agentic Web

MIT research points to a structural shift: moving beyond siloed agents to an Agentic Web, enabled by protocols like MCP, A2A, and NANDA. In this environment:

- Procurement agents such as Pactum will negotiate contracts autonomously.

- Service agents will coordinate across platforms without human mediation.

- Entire workflows will emerge and self-optimize across organizational boundaries.

Bottom line: agentic infrastructure is not optional – it is the foundation of the next economy.

Market Implications: From FOMO to Fundamentals

In the current landscape, investor FOMO is real. The fear of missing the next OpenAI has catalyzed funding at a frantic pace. But that’s also where strategic discipline matters most.

We see capital splitting along two paths:

| Capital Archetype | Behavior in Agentic AI Hype |

| Tourist Capital | Follows buzzwords, favors surface-level demos, chases multiple bets without adequate operational diligence. |

| Thesis-Driven Capital | Digs into workflows, understands industry-specific constraints, backs infra-enablers and deployment-focused platforms. |

The former is fueling temporary valuations. The latter is quietly building the winners of the next decade.

Strategic Takeaways for Operators and Builders

If you’re building, deploying or investing in agentic AI, consider these principles:

- Narrow beats broad – Focus on one vertical with deep domain data and real-world frictions.

- Painkillers beat vitamins – Focus first on high-cost, error-prone workflows rather than offering incremental productivity boosts.

- Infrastructure is part of the product – Compute access, latency management, and governance tooling are not optional – they are a critical part of the new user experience.

- Auditable intelligence is the new UX – Agent decisions must be traceable, reversible, and defensible, especially in regulated sectors.

- Trust grows with constraints – The more regulated or mission-critical the application, the higher the barriers to entry – and the greater the long-term moat.

Final Takeaway: The Next Cycle Belongs to Builders with Patience

As we enter the digestion phase of the agentic AI surge, the overfunded, overhyped players will struggle with scaling and retention. Meanwhile, the durable companies will be those that:

- Align tightly with real-world processes,

- Own or can influence their infrastructure bottlenecks,

- Prioritize measured, outcome-tied deployments over flashy demos.

Agentic AI is real – but true autonomy is still scarce today. It requires systems that learn, infrastructure that sustains, and deployments that deliver meaningful P&L impact. As with electricity or the microchip, its value will be realized through systems thinking, operational discipline, and the unglamorous work of solving actual problems.

As in every hype cycle, most will fail. The winners won’t be those who shouted the loudest, but those who delivered the most valuable business outcomes at scale, combining agentic infrastructure with learning-capable agents.

About Moneta

Moneta is a boutique investment banking firm that specializes in advising growth stage companies through transformational changes including major transactions such as mergers and acquisitions, private placements, public offerings, obtaining debt, structure optimization, and other capital markets and divestiture / liquidity events. Additionally, and on a selective basis, we support pre-cash-flow companies to fulfill their project finance needs.

We are proud to be a female-founded and led Canadian firm. Our head office is located in Vancouver, and we have presence in Calgary, Edmonton, and Toronto, as well as representation in Europe and the Middle East. Our partners bring decades of experience across a wide variety of sectors which enables us to deliver exceptional results for our clients in realizing their capital markets and strategic goals. Our partners are supported by a team of some of Canada’s most qualified associates, analysts, and admin personnel.